www.chinadaily.com.cn

European network of Chinese banks grows

Updated: 2012-07-13 12:32

By Fu Jing (China Daily)

An emerging network of Chinese banks is gradually unfolding across the European continent, with corporate and private clients standing to benefit from the additional services.

While Chinese banks in London, Paris, Frankfurt and other cities in western Europe offer nearly all the services as European banks do, their newly opened branches in Brussels and other cities can only provide limited services.

They are still waiting for signals from local banking regulatory authorities to expand their services, including issuing debit and credit cards.

Chinese companies, students and office representatives are the banks' major clients, but some businessmen are thinking bigger.

|

|

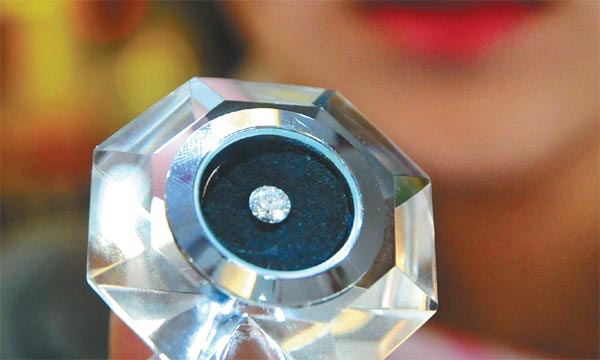

A 1-carat diamond in a jewellry store in Qingdao, Shandong province. Chinese banks can help support the development of the Chinese diamond industry in the global market, said an industry insider. Yu Fangping / For China Daily |

"These banks can help Chinese businessmen obtain strategic positions in some sectors," said Zhu Ping, a Chinese diamond dealer active in the world-famous diamond street in Antwerp.

Zhu says Chinese banks can help support the development of the Chinese diamond industry in the global market. "China is the biggest market in this industry and Chinese businessmen should have a stake and say in it. Chinese banks can help realise this," Zhu said.

He cited the development of India's diamond industry. "The tremendous expansion of India on the diamond market during the past 30 years is only possible with the boost from Indian banks, which continuously provide loans and other business facilitation."

In recent years, three Indian companies, Rose blue, Eurostar and Diarough, have carved out a firm foothold in the diamond market.

As Chinese diamond dealers are struggling at their own expense, "Chinese banks should support Chinese private investors with financing means and therefore play a leveraging role for the whole industry", Zhu said.

Stamatina Markou, head of the Information Department of the Hellenic Chinese Chamber, says Chinese banks' expansion "is not simply a fruit of their growing ambitions".

"It goes together with the economic needs of both sides," said Markou, whose organisation is based in Athens.

Europe has already been experiencing flourishing exchanges and projects of co-operation with China in recent years. Markou said the network of Chinese banks' representative offices can therefore directly serve European companies engaged with China.

Unlike some European media that have been raising their voices over Chinese bankers' moves into Europe, she speaks highly of the role that Chinese banks have played in helping increase the liquidity through loans to businesses related to two parties.

Markou encourages her European counterparts to embrace Chinese banks' operations in Europe.

"It would be necessary for increasing investment projects and empowering the government bond market. Chinese capital may add to European banks' strength."

"The expansion of Chinese banks in Europe is a natural consequence of an expanding Chinese economy to the world," said Zhou Ze, an engineer of the Belgium-based Freefield Technologies.

But Zhou said Chinese banks must also adapt to local regulations and rules. "They must also learn to operate in a competitive market," Zhou said, adding he has not opened any account in Chinese banks in Belgium as the services here are still fledging but he will do so when these are more mature.

Tan Xuan contributed to the story.